Ordering Dollars: A Comprehensive Guide to Your Financial Needs

Ordering dollars is a crucial element in the realm of finance and commerce. Whether you are a business owner seeking to streamline your cash flow, an entrepreneur hunting for investment capital, or simply an individual trying to manage personal finances, understanding the nuances of ordering dollars can significantly impact your financial success.

Understanding the Concept of Ordering Dollars

Ordering dollars refers to the process of requesting or acquiring a specific amount of money, usually in the form of currency. This could involve various methods, such as bank transfers, loans, or even online financial services. Because of its significance in both personal and professional economic activities, mastering this process is essential for anyone aiming to thrive in today's competitive environment.

The Importance of Ordering Dollars in Business

In the business world, ordering dollars can be a game-changer. It provides the necessary liquidity for operations, investments, and growth. Here are some key reasons why understanding this process is vital:

- Cash Flow Management: Ensures that your business has enough cash flow to meet operational expenses.

- Investment Opportunities: Facilitates quick access to funds for seizing lucrative investment opportunities.

- Financial Stability: Contributes to maintaining financial stability, which is essential for long-term success.

- Creditworthiness: Regularly ordering and managing funds can improve your credit profile, enhancing your borrowing capabilities.

How to Order Dollars: A Step-by-Step Guide

Now that we understand the importance of ordering dollars, let’s delve into how to effectively carry out this process. Below, we outline a simple step-by-step guide to help you navigate through ordering dollars successfully.

Step 1: Assess Your Financial Needs

Before you can effectively order dollars, you need to determine how much you need. Assessing your financial requirements can include:

- Calculating operational costs for running your business.

- Identifying potential investment opportunities and the funds required to pursue them.

- Considering unexpected expenses that may arise.

Step 2: Explore Available Options

Once you have a clear idea of how much money you need, the next step is to explore your available options for ordering dollars. Here are some common methods:

- Bank Loans: Traditional way of obtaining funds, typically requiring a detailed application process.

- Online Lenders: Increasingly popular due to the ease of access and faster processing times.

- Peer-to-Peer Lending: Platforms that connect borrowers directly with individual lenders.

- Credit Cards: Useful for smaller amounts but can carry high-interest rates.

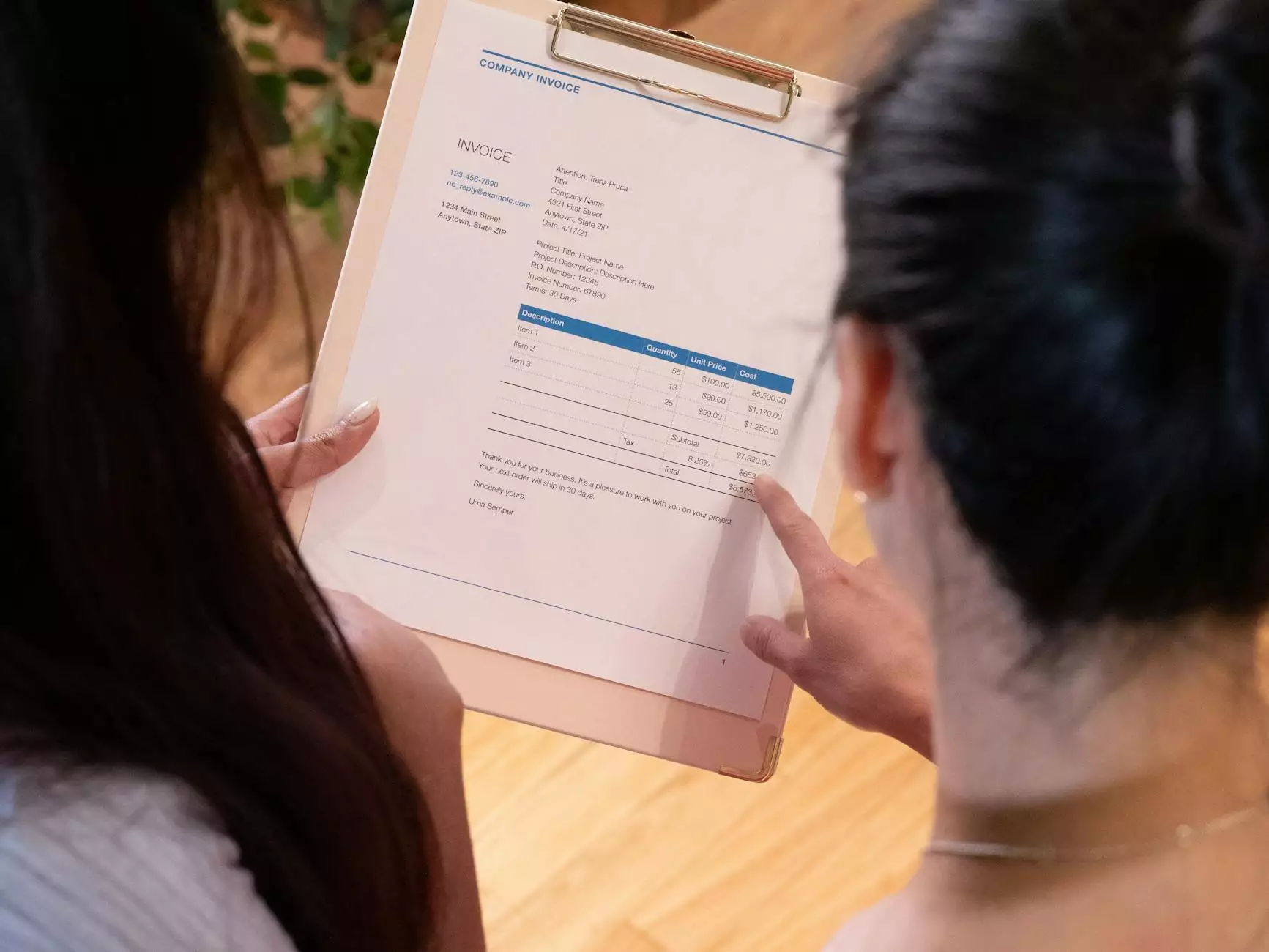

Step 3: Prepare Your Documentation

Document preparation is critical in the ordering dollars process. Ensure you have all necessary documentation ready, including:

- Business financial statements.

- Personal credit report.

- A detailed business plan outlining how you intend to use the funds.

Step 4: Apply and Await Approval

With your options chosen and documents prepared, you can now order dollars by submitting your application. Be prepared for waiting periods depending on the lender’s review process, which can vary significantly.

Step 5: Utilize the Funds Wisely

Once your application is approved and the funds are in your account, it’s time to put them to work. Be strategic about how you spend your money, ensuring it aligns with your business goals.

Best Practices for Ordering Dollars

To ensure that your process of ordering dollars is as smooth and efficient as possible, consider the following best practices:

- Compare Lenders: Do thorough research to find the best rates and terms.

- Understand Your Debt: Avoid overextending yourself financially by understanding your repayment capacity.

- Maintain a Good Credit Score: A solid credit history can unlock better interest rates and terms.

- Keep Financial Records: Track your finances accurately to make informed upcoming financial decisions.

Potential Risks of Ordering Dollars

While ordering dollars is essential for many businesses, it’s vital to be aware of the risks involved:

- High Interest Rates: Many lenders charge high-interest rates, which can lead to a cycle of debt if not managed properly.

- Over-reliance on Debt: Depending too heavily on loans can jeopardize your financial health.

- Potential for Financial Instability: Poorly managed funds can lead to financial difficulties.

Innovative Trends in Ordering Dollars

As technology evolves, so do the methods of ordering dollars. Here are some innovative trends that are shaping the future of financial acquisitions:

- Blockchain and Cryptocurrency: Innovations in blockchain technology are revolutionizing how funds are transferred and ordered, making the process faster and more secure.

- FinTech Solutions: Various applications and platforms now simplify the process, offering personalized loan products tailored to individual needs.

- Peer-to-Peer Transactions: An increasing number of people are opting for peer-to-peer lending as a viable alternative to traditional banking systems.

Conclusion: Mastering the Art of Ordering Dollars

In conclusion, ordering dollars is a multifaceted process crucial for anyone looking to improve their financial situation—be it for business or personal use. By understanding the options available, preparing adequately, and employing best practices, individuals and businesses can navigate this process to achieve their financial objectives. As we adapt to the changing landscape of finance, staying informed and strategic in ordering dollars will help pave the way for prosperity and growth.

Remember, whether you're venturing into online lending or exploring innovative financial technologies, the key to successful ordering lies in knowledge and strategic execution.